It really is unusual for head cash advance providers to call to have telechecks in any other case manner an excessive amount of serious borrowing research to own enjoy. While you are such challenge try examined, they may by no means be essential objects of the application procedure. Essentially, these monetary establishments markets themselves because the “second-chance” streams. This new allowed procedure could probably get perform a heightened diploma of freedom in an effort to men having careworn financial information.

3. For accredited in-store loans, you’ll obtain funds instantly. For online loans, approval and funding might require verification of software info. Depending on means to confirm this data, mortgage funding may be extended up to 2 days. All loans subject to approval pursuant to straightforward underwriting standards. In-retailer money pickup of online loans is topic to approval pursuant to straightforward underwriting standards and only available at ACE Money Specific locations in the state where you originated your loan. In-retailer money pickup of on-line loans not accessible in all states. In-store cash pickup of online loans requires valid, non-non permanent authorities-issued identification. Online loans not out there in all states.

If you don’t qualify for a longer repayment interval, maybe since you run a new startup and haven’t yet built your credit, look at loans which have a minimal credit score requirement or that have a look at different elements, such as your annual revenues. You might also qualify for enterprise credit playing cards.

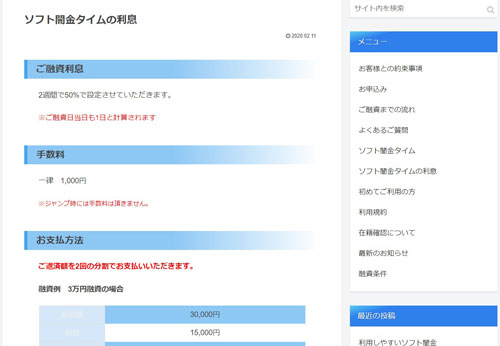

The rates and price buildings for small business loans are subject to vary without discover, and they often fluctuate in accordance with the prime fee. Nonetheless, when you settle for ソフト闇金まるきん your mortgage agreement, a fixed-rate APR will assure that the interest rate and monthly payment will stay constant throughout the whole time period of the loan. Your APR, monthly payment and loan amount depend on your credit score historical past and creditworthiness.

With a small enterprise time period mortgage, you receive a lump sum of cash abruptly and begin getting charged interest as soon as you obtain the mortgage cash. As you make common funds, your loan balance, or the money you owe, decreases. And then, once the loan has been paid off, your loan settlement ends.